Stopping financial crimes has become more difficult because criminals are using smarter ways to hide illegal money. Traditional methods often do not catch these activities in time. Artificial intelligence (AI) is helping to address this issue. AI helps banks and financial companies quickly find unusual transactions that might be linked to money laundering.

In 2023, the global market for AML software was expected to reach $1.77 billion, showing how important AI-driven solutions have become. By using AI, financial institutions can detect risks faster, reduce human errors, and improve their security measures. This technology is changing the way financial crimes are prevented, making the process more efficient and reliable.

Understanding Money Laundering

Money laundering is the process of disguising illegally obtained money to make it appear legal. It typically involves three stages: placement, layering, and integration. In the placement stage, “dirty money” is introduced into the financial system through deposits or purchases. During layering, the money is moved through complex transactions, like transfers across accounts or buying assets, to hide its origin. Finally, in the integration stage, the cleaned money reenters the economy, appearing legitimate, often through business investments, paying employees, or charitable activities. This process helps criminals legitimize illicit funds and avoid detection by authorities.

Key Takeaways

- AI Applications in Financial Crime Detection and Prevention

- The Shift Toward AI in Anti-Money Laundering

- How to Intensify Detection with AI-Driven Analysis?

- Benefits of Using AI for AML Compliance

- Concluding Remarks

- FAQs

AI Applications in Financial Crime Detection and Prevention

Artificial Intelligence (AI) is transforming how financial institutions approach Anti-Money Laundering (AML) compliance. Traditional AML systems often rely on rule-based engines that generate large volumes of alerts, many of which are false positives. AI introduces a more intelligent and dynamic layer to these systems, enabling faster, more accurate, and more scalable compliance.

Key Roles AI Plays in AML Compliance:

- Advanced Transaction Monitoring

AI systems can analyze vast amounts of transactional data in real time to detect unusual behavior and patterns that may indicate money laundering. Unlike static rule-based systems, AI models can learn and adapt over time to improve detection. - Customer Risk Profiling

Through machine learning, AI can develop more nuanced and dynamic customer risk profiles by continuously analyzing customer behavior, transaction history, and external data sources. - Suspicious Activity Detection

Natural language processing (NLP) and predictive analytics enable AI to flag suspicious activities with higher precision. These tools can also assist in automating the generation of Suspicious Activity Reports (SARs). - Reduction of False Positives

One of the major challenges in AML compliance is the high rate of false positives. AI can significantly reduce these by improving the accuracy of alerts, helping compliance teams focus on genuine threats. - Automation of Compliance Processes

AI can automate repetitive tasks such as Know Your Customer (KYC) checks, sanctions screening, and case management—reducing manual effort and increasing efficiency. - Continuous Learning and Adaptation

AI models can be retrained with new data, enabling financial institutions to stay ahead of emerging money laundering techniques and regulatory changes.

The Shift Toward AI in Anti-Money Laundering

The fight against financial crimes has evolved significantly with the introduction of artificial intelligence. Traditional anti-money laundering (AML) methods, while effective in the past, find it hard to keep up with more advanced money laundering tactics. AI in AML compliance is now at the forefront, offering precision, adaptability, and efficiency in detecting fraudulent activities.

Financial institutions must meet ever-tightening regulations while handling massive transaction volumes. AI provides an advanced way to monitor financial movements, recognize suspicious patterns, and minimize errors. Unlike conventional rule-based systems that require constant manual updates, AI learns from real-time data, adapting to emerging threats with greater accuracy.

How to Intensify Detection with AI-Driven Analysis?

One of AI’s most impactful contributions to AML is its ability to process enormous data sets in seconds, uncovering irregularities that might go unnoticed through manual reviews. AI models look at transaction histories, customer behavior, and external data sources to identify unusual activities. This capability not only reduces false positives but also prioritizes high-risk cases, allowing compliance teams to focus on genuine threats. An AI legal research tool can further enhance this process by analyzing case law and regulatory precedents, helping financial institutions align their detection strategies with evolving legal standards.

Machine learning is a key part of AI. It improves its ability to tell the difference between real and suspicious transactions. Over time, these systems become more effective, ensuring faster and more reliable detection of illicit financial activities.

AI-Powered Transaction Monitoring and Risk Assessment

Monitoring financial transactions manually is time-consuming and often ineffective. AI transforms this process by scanning transactions in real time and evaluating risk based on behavior patterns rather than rigid, predefined rules. This dynamic approach makes it possible to detect evolving laundering techniques before they cause significant damage.

Risk assessment is another area where AI is making a difference. By analyzing diverse data points, AI assigns risk scores to customers and transactions, allowing financial institutions to take preventive measures before violations occur. This proactive approach strengthens AML compliance while optimizing operational efficiency.

Automating Suspicious Activity Reporting

Filing reports on suspicious activities is a regulatory requirement, but the process can be labor-intensive and prone to delays. AI simplifies this by automatically compiling relevant data, identifying critical details, and generating comprehensive reports with greater accuracy. This automation reduces human workload and ensures regulatory obligations are met in a timely manner.

AI also helps institutions maintain compliance across multiple jurisdictions by adapting to different regulatory frameworks. As global financial regulations evolve, AI-driven systems adjust accordingly, minimizing the risk of non-compliance. Additionally, AI enhances device security by detecting and preventing unauthorized access to sensitive financial data.

Benefits of Using AI for AML Compliance

Implementing Artificial Intelligence (AI) in Anti-Money Laundering (AML) compliance offers a range of significant advantages for financial institutions and regulated businesses:

- Improved Accuracy

AI-powered solutions enhance the accuracy of AML programs by analyzing vast datasets and identifying suspicious patterns with greater precision. This reduces the number of false positives, enabling compliance teams to focus on genuine threats. - Cost Efficiency

By automating routine compliance tasks such as transaction monitoring, risk scoring, and customer due diligence, AI can significantly reduce operational costs while increasing throughput and consistency. - Enhanced Regulatory Compliance

AI helps institutions stay ahead of evolving regulatory requirements by continuously adapting to new typologies and improving detection capabilities. This leads to more robust compliance and reduced risk of regulatory penalties. - Improved Customer Experience

Streamlined AML processes powered by AI can lead to faster onboarding, fewer service disruptions, and less intrusive verification procedures—resulting in a smoother and more customer-friendly experience.

Overcoming Challenges in AI Adoption for AML

While AI brings numerous benefits to AML operations, it presents organizations with adoption difficulties. The primary issue regarding AI adoption in AML protection is the need for extensive financial data access by these systems. Data protection policies need to become strictly enforced by institutions in order to comply with privacy regulations.

AI models can be hard for human analysts to understand. The implementation of AI systems in detection operations demands transparent decision-making mechanisms for regulatory monitoring purposes. Research groups aim to create AI systems which generate detailed explanations about suspicious activities identified during operations.

Concluding Remarks

AI solutions for AML are currently undergoing development adjustments, which determine how they will protect financial operations in the future. The capabilities for fraud detection will receive additional improvement through innovative advancements of deep learning combined with blockchain integration. Financial institutions retain an advantage over criminals because AI possesses automatic adaptivity which extends to its capacity for learning.

Financial security for transactions and economies depends heavily on the implementation of AI-based anti-money laundering solutions as financial systems become increasingly sophisticated. Evolving AI capabilities will transform how organizations approach compliance by creating more accurate and faster financial crime prevention measures that promptly address developing threats.

FAQs

- How does AI improve the accuracy of AML compliance?

AI improves AML accuracy by analyzing vast data sets in real time to detect unusual patterns and behaviors. This reduces false positives and helps compliance teams focus on legitimate threats rather than wasting time on non-risky alerts. - Can AI completely replace human analysts in AML operations?

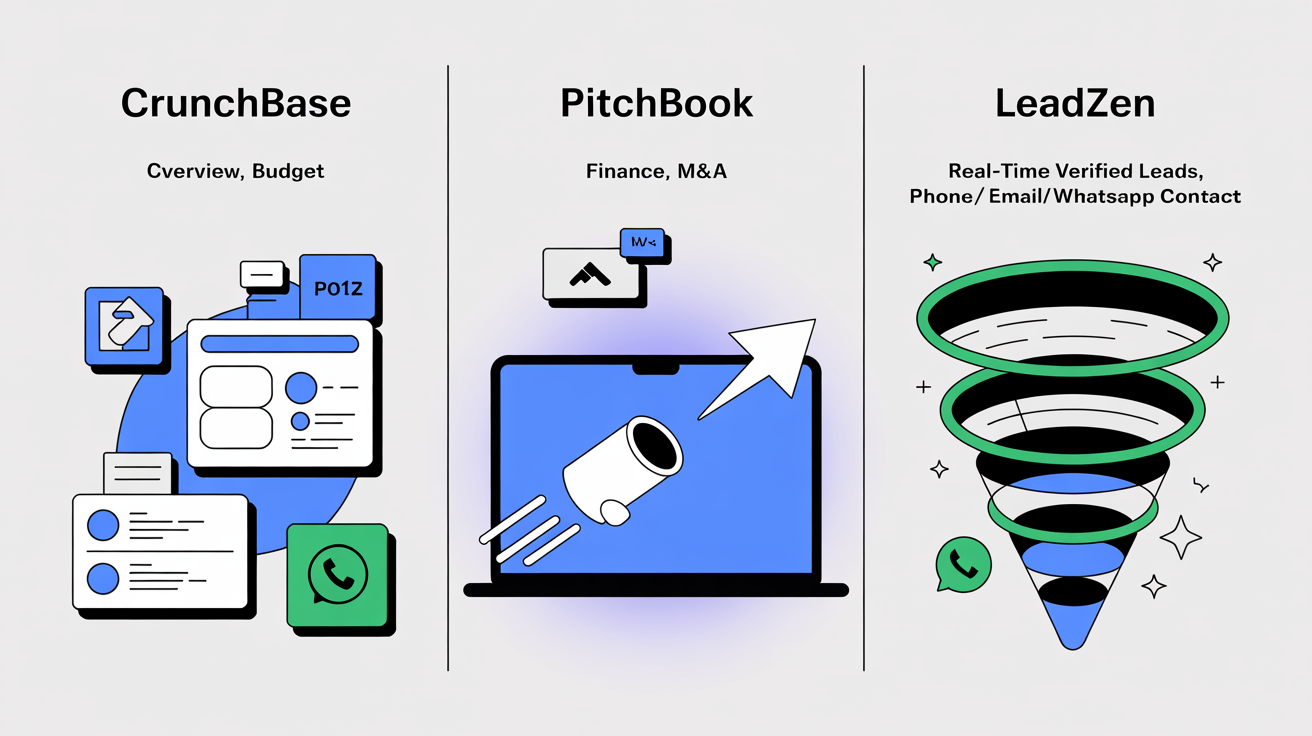

No, AI is meant to assist, not replace, human analysts. While AI can automate repetitive tasks and enhance detection, human expertise is still essential for final decision-making, contextual understanding, and regulatory reporting. - What are some examples of AI tools used in AML processes?

Common AI tools in AML include machine learning algorithms for transaction monitoring, natural language processing (NLP) for document analysis and suspicious activity detection, and robotic process automation (RPA) for KYC and compliance workflows. - How does AI help reduce compliance costs?

By automating routine processes like transaction monitoring, customer onboarding, and report generation, AI reduces manual workload and operational inefficiencies—leading to significant cost savings over time. - Are AI-powered AML systems compliant with global regulations?

Yes, most advanced AI-powered AML systems are designed to adapt to evolving regulatory standards across different jurisdictions. They help ensure compliance by adjusting to rule changes and improving reporting accuracy.